The retail markets remain in flux. Recession and inflation are picking up speed. Meaning that consumers are facing rising living costs.

According to Fitch’s latest Global Economic Outlook, consumer spending will grow at a meager 0.9% in 2023. However, more decisive fiscal measures around interest rate policies and higher inflation may ease the spending crunch.

When disposable income dips, consumer lending often picks up speed. Since 2020, buy now, pay later (BNPL) services have grown at double-digit rates. Global BNPL payments stood at $614 billion in 2022 and will now experience further growth by 44.2% annually.

McKinsey further forecasts that point-of-sale (POS) financing will account for 13-15% of unsecured lending balances in the US in 2023, outpacing growth for consumer credit cards and personal loans.

The above data begs the question: Should your company jump on the buy now pay later technology bandwagon too? By the end of this post, you should be able to decide.

What is Buy Now Pay Later (BNPL)? A Quick Refresher

Buy Now, Pay Later (BNPL) is a form of flexible point-of-sale (POS) financing that allows consumers to pay for selected goods in installments or make a lump sum payment later.

POS lending isn’t a new concept per se. Consumers had no shortage of options before — from branded store credit cards to loyalty-based instant loan enrollment.

What buy now pay later technology has changed is the experience of obtaining credit. BNPL services are embedded directly into an ecommerce platform, making the lending experience a two-click affair. There are a few steps in the sign-up form. No lengthy approvals or extended credit checks. So no wonder businesses see an average increase of 20-30% in conversion rate after adopting a buy now pay later app.

The latter is easy to do as BNPL platforms like Klarna, Affirm, and Sezzle, among others, lure retailers with a straightforward technical implementation process. For instance, if you’re using BigCommerce as your ecommerce platform, you have a pre-made integration to Klarna. Also, you can add custom integrations with other BNPL apps relatively fast using open APIs.

For consumers, BNPL services provide a convenient way to obtain credit. For retailers, BNPL doesn’t require putting any working capital at risk or dealing with regulators to obtain lending compliance.

Why New Players Should Enter The Booming BNPL Market in 2023

The global BNPL market stood at $22.86 billion in 2022 and will keep increasing at a CAGR of 21.7% until 2029. Though there are already several established BNPL players, the demand for such services continues to grow.

Most BNPL platforms target B2C commerce markets in North America and Western Europe. Still, ample growth opportunities exist in other regions and market verticals.

If you’re planning to pursue buy now pay later software development this year, consider the following four product development vectors.

Underserviced Regional Markets

BNPL services first took off in the US and then spread to Canada and larger Western European economies like Germany, France, and Spain. In 2023, the consumer interest and usage rate will be picking up speed in other regions.

- In Poland, BNPL payments have grown by 70.9% annually, totaling $1,36 million in 2022.

- In Australia, around 17% of all ecommerce transactions are expected to be paid for in installments in 2023.

- In South Korea, BNPL payment adoption is likely to grow at a CAGR of 27% during 2022-2028.

In regions like the Middle East, where access to banking services is scarce, BNPL providers see an even more streamlined path to adoption. For instance, an Egyptian pay later app, Shahry, saw a 100% month-on-month growth by targeting the underbanked as their prime audience.

Selecting a smaller regional market as a target launch destination can validate your product idea and secure early traction before entering a more competitive market.

BNPL services for B2B

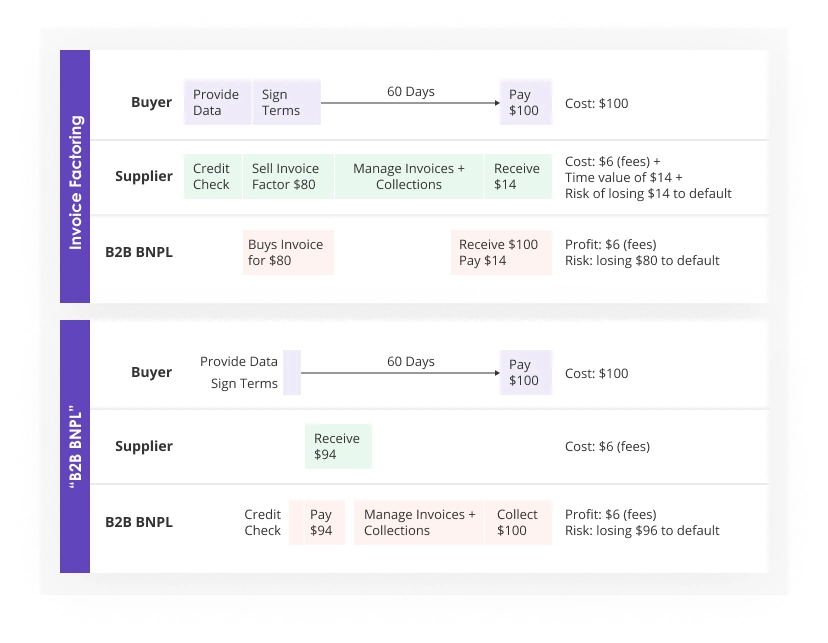

For years, the B2B sector has suffered from flawed net terms (Net 60+), which complicate cash flow management for the suppliers. The new breed of B2B BNPL companies like Balance, Slope, and Vartana, among others, attempt to fix the broken payment cycles.

These BNPL apps embed themselves into the B2B sales process to provide instant net terms to end buyers. Suppliers, in turn, get paid instantly and don’t have to chase up later payments or overdue invoices. The BNPL platform algorithmically manages all credit decisions and carries the default risks.

Source: Greylock

Given that the B2B payment sector is approximately 2X bigger than the B2C payments sector, success can come easier in this niche. Moreover, business lending has fewer regulatory issues than consumer financing in many regional markets.

BNPL for Luxury Purchases

The luxury market traditionally catered to well-off consumer demographics. Yet, this is changing as middle-class consumers double down on opulent purchases too. In the US, middle-class consumers “trade up” by paying a premium for certain luxury items like extravagant vacations or designer clothes and compensate by “trading down” in other areas. Pay later apps enable them to pursue this juggling act without accumulating high-interest debt.

Younger consumers with higher net worth are also interested in BNPL apps. According to a recent PYMNTS survey,

- 56% of all respondents stated they were “highly interested” in using installment payments for online purchases.

- 46% of department store shoppers would switch to another retailer if their preferred store didn’t offer installment payments.

At the same time, the booming resale market also attracted new demographics to the luxury segment. Online platforms specializing in resales have early recognized the appeal of BNPL for consumers. Vestiaire Collective, for example, has already seen positive traction from adopting a BNPL app. The team also expects that:

“BNPL will play a more significant role in Vestiaire Collective’s business model in the future in terms of scale and impact on customer experience. Because it provides consumers with greater payment flexibility, BNPL options drive recurring purchases on its marketplace.”

Some luxury brands see BNPL as a way to reach younger, more price-sensitive customers who may not have the disposable income to make large purchases upfront. Others see BNPL as a way to appeal to existing customers who may be more hesitant to make large purchases during economic downturns.

BNPL for Services Purchases

So far, BNPL platforms have proliferated in goods purchases. But high-ticket service purchases in domains like healthcare and education are another promising growth avenue.

Over 40% of US consumers showed interest in BNPL for travel, home remodeling, medicine, and prescription services.

BNPL can be a great solution for vocational or professional education. Educational loans, which presently cover it, come with high-interest rates. Marcus Sellen of Hader Institute in Australia, an early adopter of a BNPL service, says that BNPL has made the financing process simpler for everyone:

“It removes the admin and collection burden from us and it’s an attractive option for students who can pay their course off in a way that suits them.”

In the travel industry, BNPL is also largely seen as a positive way to maintain the rise in trip bookings amidst the changing economic conditions. British Pay Later Group, for example, recently branched into travel with a standalone Fly Now Pay Later app, which allows spreading the cost of upcoming travel into flexible monthly installments. Klarna, in turn, partnered with the Expedia Group to provide payment plans for its customers.

Branching out into the services vertical can help new and established BNPL services reach new customer segments without facing much competition (for now).

Buy Now Pay Later App Development: Best Practices

The BNPL trend has exploded in recent years and continues to gain traction. If you are planning to enter this domain, consider a number of best practices to ensure the success of your app and the satisfaction of your users.

In this article, we will discuss some key points to remember when strategizing on BNPL app development.

1. Prioritize Convenient User Onboarding

Impeccable end-user experience (UX) is a strong selling point of BNPL platforms. Unlike earlier POS lending software, BNPL apps require fewer user inputs and automate compliance processes like KYC/AML.

The sprawling FinTech market already has many API-based solutions for performing digital user ID verification, background, and “light” credit checks. Use the available embeddable solutions to streamline app development without compromising security.

Additionally, you can minimize your risk exposure by setting dynamic controls for the dollar amount that BNPL offers. Place minimal limits for new users who provide essential information only. Request extra credit information at later stages by extending a promise of a higher credit limit or extra flexibility in repayment cycles.

2. Leverage Extra Credit Data

Consider incorporating alternative credit data sources beyond credit scores to approve more customers without carrying extra operational risks.

Alternative credit data includes:

- Merchant-specific data: customer purchase history, past refund requests, loyalty status, etc.

- User-supplied data: Tax returns, utility payments, rental payments, bank account statements, etc.

The above can be fed into your lending engine to optimize KYC and loan underwriting processes.

Using such data sources will require updates to your credit engines and likely extra investments in data science — an area where Edvantis can help.

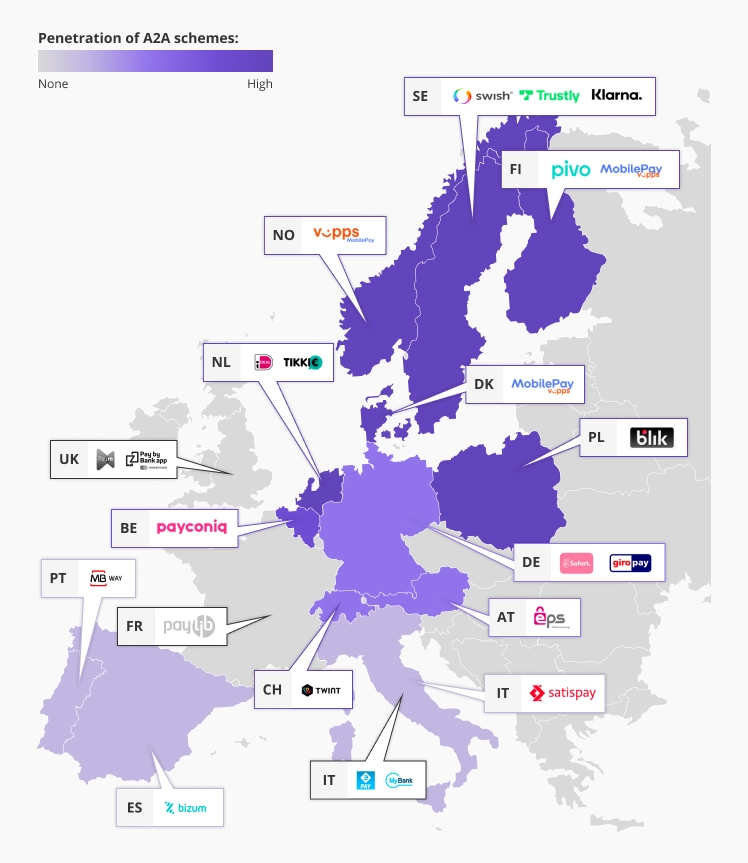

3. Opt for an Account-to-Account (A2A) Payment Process

An account-to-account (A2A) payment is a way to send money between two bank accounts without involving any intermediaries such as debit or credit cards. For BNPL platforms, A2A offers an effective way of optimizing operating costs by eliminating most transactional fees or lengthy settlement times.

Thanks to Open Banking, European BNPL players can start supporting A2A payments without facing many regulatory or compliance hurdles (as many already do, in fact).

Source: Flagship

Globally, similar legislative payments for A2A payments are now active in the UK (Faster Payment System), Brazil (PIX), and India (Unified Payments Interface). Johan Strand, CEO of Zimpler, estimates that roughly 70% of the world’s population could access instant account-to-account payments with live – and announced – initiatives this year.

On the app development side, A2A payment process implementation requires knowledge of the PSD2 directive and its technological frameworks, such as PCI-DSS/PCI-SSF.

4. Mind PCI DSS and Newer PCI SSF requirements

The Payment Card Industry Data Security Standard (PCI DSS) is a set of twelve information security standards businesses operating in the EU must follow when dealing with customer debit/credit card data.

Key PCI DSS provisions include requirements for:

- Firewall configurations and anti-virus software usage

- Payment system security configurations

- Secure cardholder data storage

- Network security monitoring

- Secure app development practices

- Overall cybersecurity policies

Companies can also obtain a PCI DSS compliance certification, which acts as a powerful industry trust signal and, in some cases, is a regulatory requirement.

In January 2019, the PCI Council published another certification framework called Secure Software Lifecycle (PCI SSF). In October 2022, PCI SSF replaced an earlier PA DSS as a benchmark standard.

BNPL services have to meet PCI SSF compliance requirements to avoid regulatory action in European markets. Read our in-depth explainer about PCI DSS/PCI SSF to understand the prerequisites and myths surrounding this process.

To Conclude

As marketers remain in flux, cash-strapped consumers and businesses alike will continue seeking flexible financing offers. BNPL products have already proven to generate higher ROI for retailers (who, in turn, rush to adopt them as per consumers’ cue). Yet many market verticals remain underserviced, presenting new pockets of growth for decisive movers.

Edvantis would be happy to assist you with BNPL app development. We have significant expertise in both payment and ecommerce domains, as well as experience in helping obtain PCI DSS certifications. Contact us!