The client, Collenda, needed to digitalize their products, due to competitive pressure from FinTech startups and other financial companies.

-

Service

Managed Team

-

Industry

Finance

-

Location

Germany

About the Company

Collenda supplies digital products to their customer base of over 700 banks, corporate lenders, and debt collection agencies throughout Europe. The company’s main purpose is to help its clients conduct more efficient credit operations and improve the effectiveness of their collection efforts.

Challenge

Due to the rising competitive pressure from FinTech startups and other financial companies, Collenda decided that it was time to ramp up their product digitalization, too.

The company struggled to find local engineering talent and decided to try IT outsourcing instead. Edvantis was selected as the services provider from a number of contenders.

“[Edvantis] work was well received by our internal team as well. We wouldn’t have gained this technology leap without them, and we really appreciate the work that they’ve done. The architects were very skilled and had their own ideas to implement the features.”

Christoph Tahedl, CTO at Collenda

From March 2019, we had six engineers on the project, working in two teams. Collenda commented that our professionalism and flexibility in resources scaling in the Capacity Service Model, were the decisive factors.

Main Goals

- To upgrade the legacy web application and technology stack for improved usability and performance

- To roll out self-service portals for end customers applying for loans or debt restructuring

- To switch to responsive, mobile-friendly web design technology to deliver a better user experience

Technologies Used

JavaScript, React JS, Spring Boot, JSF, PrimeFaces

Solution

Edvantis engineers coordinated effectively with Collenda’s internal teams, so that the one-year timeline was met. Collenda relies on agile methodology, setting key sprint goals and providing user stories that our teams delivered on.

The smooth cooperation has already yielded significant results for Collenda. The joint team has executed:

- Front-end re-design for the credit management software suite, powered by React.js.

- Lending portal re-architecture, using Spring Boot for the backend.

- New loan application development using Javaserver Faces for component-based user interfaces.

- Lending application porting to React.js to improve user satisfaction with the product. while preserving HTML/JSP component functionality to ensure smooth app performance.

- A host of additional integrations with different systems.

One challenge our engineers faced was the need to port Primefaces to React.js within the loan portal. We had to make major changes to the application backend, which resulted in significant performance improvements.

Additionally, we reduced code generation based on XML for the open credit solution. We found an elegant solution to preserve XML metadata, while ensuring that all the UI was built dynamically at runtime. This was possible thanks to Collenda’s engineering team insights and proactive knowledge sharing.

“If you want to introduce new technology to your team, the input coming from Edvantis helps to speed up, helps to find new ideas, and helps find developers that have these skills.”

Christoph Tahedl, CTO at Collenda

Results

Edvantis teams are successfully co-creating new products with Collenda. Our developers have fully integrated into the company’s operations and developed a deep knowledge of its core systems and portfolio products.

Together, we performed two major system updates and contributed to the release of the following innovative products:

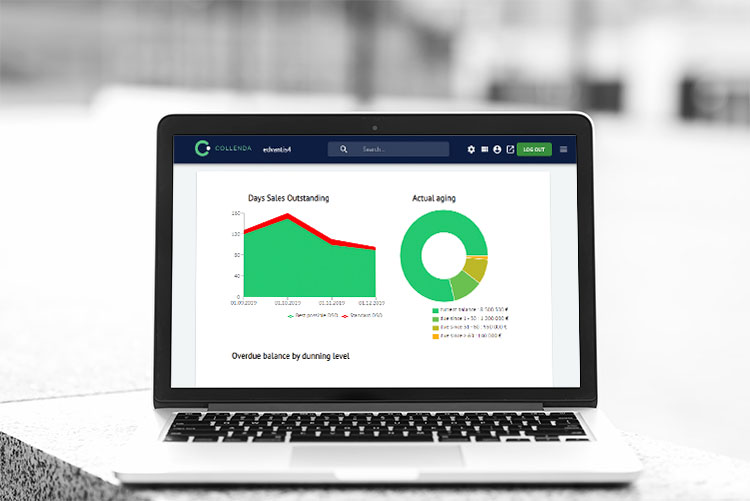

- Open Credit 4.0 — an integrated credit management platform, featuring smart, AI-driven workflows, aimed at helping financial agents deliver more efficient, consistent, and personalized services.

- A new lending portal, integrated with Open Credit 4.0. A user-friendly and intuitive cloud-based solution for loan applications and processing.

In addition, our team helped migrate extensive databases and source code from German to English to further improve product maintainability.